Whenever money is paid out, the Money account is credited (and one other account is debited). Whenever cash is received, the Money account is debited (and another account is credited). Accountants and bookkeepers usually use T-accounts as a visible aid to see the impact of a transaction or journal entry on the 2 (or more) accounts involved. Common ledger accounts are known as T-accounts as a result of we draft them within the shape of the letter T. Debit items are always recorded on the left facet, while credit score objects are documented on the proper aspect of the T-account.

Everlasting accounts aren’t closed on the finish of the accounting year; their balances are routinely carried forward to the next accounting yr. To decrease an account you do the alternative of what was done to extend the account. For example, an asset account is increased with a debit.

- In accounting, belongings, liabilities, and fairness are the three significant components of the steadiness sheet.

- Every transaction your small business makes has to be recorded in your steadiness sheet.

- Many individuals use acronyms to remember which accounts are elevated by debits and which by credits.

Debits Vs Credits: Accounting Guidelines Defined For Small Businesses

Commonly, this type of accounting accommodates most well-liked or retained stock, treasury stock, and other comprehensive revenue (OCI). Nevertheless, debits and credit act totally in another way on this account, in accordance with the character of the transactions. Utilizing the identical business, let’s assume, Viva Electronics has paid its electrical energy invoice cost $80,000 by transferring money utilizing net banking. Therefore, the amount spent is growing the company’s bills, so the entries shall be posted beneath the debit column.

Credit balances go to the proper of a journal entry, with debit balances going to the left. A debit in an accounting entry will decrease an fairness or liability account. A liability account on the books of a company receiving money in advance of delivering items or services to the client.

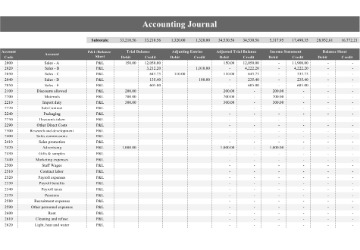

Examples embrace gross sales, purchases, asset depreciation, borrowing, and dividends. Every transaction must comply with the accounting equation of property equaling liabilities plus equity. Transactions are recorded by way of https://www.simple-accounting.org/ journal entries, both instantly or not directly by way of accounting software program modules. Journal entries must stability with equal debits and credit.

Modern accounting software program automates these processes to save time and scale back errors. Expense accounts go up with debits and down with credits. Income accounts go up with credit and down with debits. This system retains belongings equal to the sum of liabilities and fairness. Liability accounts show what an organization owes, like loans and accounts payable. Therefore, at all times consult with accounting and tax professionals for help together with your specific circumstances.

Step-by-step Transaction Analysis

Debits and credits are essential to bookkeeping and accounting. They observe changes in monetary accounts and keep the books balanced. Accounts are the bookkeeping or accounting records used to kind and retailer a company’s transactions. The accounts may be found within the company’s common ledger.

To accurately use debits and credit in your monetary transactions, you must be positive that you account for all transactions. For each transaction, you will want to discover out whether or not it is a debit or credit. You can then use this information to report the transaction in your books accurately.

When learning bookkeeping fundamentals, it’s helpful to look by way of examples of debit and credit accounting for various transactions. In basic, debit accounts embrace belongings and money, while credit accounts include fairness, liabilities, and revenue. Momentary accounts (or nominal accounts) embody all of the revenue accounts, expense accounts, the owner’s drawing account, and the income abstract account.

Have a agency grasp of how debits and credit work to maintain your books error-free. Accurate bookkeeping can give you a better understanding of your business’s monetary well being. Not to mention, you use debits and credit to organize critical monetary statements and other paperwork that you may have to share with your financial institution, accountant, the IRS, or an auditor. Equally, a credit score (Cr) represents the amount of money taken out of belongings, bills, and added to the company’s equity, liabilities, and income.